Trade Receivables Report in ALZERP Cloud ERP Software

- Alwajeez Tech

- Aug 20, 2024

- 4 min read

What is the Trade Receivable Report?

The Trade Receivable Report plays a crucial role in the financial management of a company. It serves as a detailed snapshot of the outstanding balances owed by customers at a specific point in time, highlighting the extent of credit sales that are yet to be collected. By providing a comprehensive overview of customers with pending payments, this report enables the finance and accounts department to effectively monitor and manage the company's accounts receivable.

One of the key advantages of the Trade Receivable Report is its ability to help businesses identify potential cash flow issues. By tracking overdue invoices and delinquent accounts, organizations can proactively address payment delays and minimize the risk of bad debt. This proactive approach not only enhances the company's financial stability but also improves customer relationships by ensuring timely collections and reducing payment disputes.

Furthermore, the Trade Receivable Report serves as a valuable tool for assessing the creditworthiness of customers. By analyzing the aging of receivables and identifying patterns in payment behavior, businesses can make informed decisions about extending credit terms or adjusting credit limits for individual customers. This data-driven approach to credit management can help mitigate the risk of late payments and defaults, ultimately safeguarding the company's revenue stream.

Key Features of ALZERP Trade Receivable Report

The Trade Receivable Report in ALZERP comes with several features that make it a powerful tool for financial management:

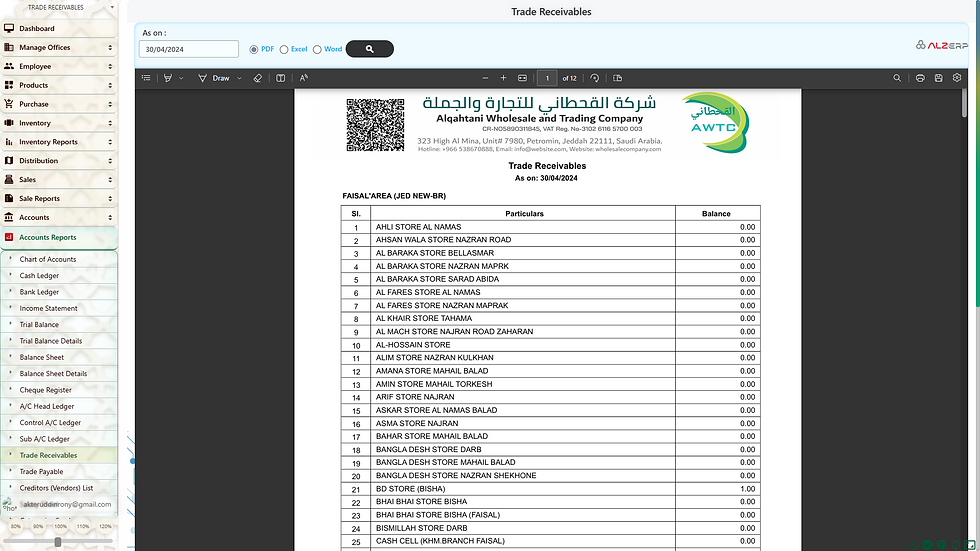

As on Date Filter:

The report allows users to define an As on Date, which specifies the exact point in time for which the outstanding balances are reported. This helps in tracking receivables for specific periods, such as the end of the month, quarter, or financial year.

Preview Option:

Before generating the final report, users can click on a magnifying glass icon to preview the data. This preview can be filtered to show either active customers or all customers, providing flexibility in how the report is reviewed. The preview feature ensures that all data is accurate and complete before the report is finalized, sent, or printed.

Professional Report Format:

Once the report is generated, it is formatted as a professionally styled document, complete with the company’s letterhead. The report can be exported in PDF format, making it easy to share via email, WhatsApp, or for printing.

How to Generate the Trade Receivable Report

Generating the Trade Receivable Report in ALZERP is a straightforward process:

Access the Search Form:

Navigate to the accounting module within ALZERP and select the option to generate the Trade Receivable Report.

Set the As on Date:

Input the specific date for which you want the report to reflect outstanding balances. This date determines which invoices are considered unpaid as of that point in time.

Preview the Report:

Click the magnifying glass icon to preview the report. You can choose to view either only active customers (those with ongoing transactions) or all customers, depending on your needs.

Generate the Final Report:

After reviewing the preview, proceed to generate the final report in PDF format. The report will be presented on the company’s letterhead, ready for distribution or printing.

Purpose and Benefits of the Trade Receivable Report

The Trade Receivable Report serves several key purposes:

Monitor Accounts Receivable:

The report helps businesses track which customers owe money, how much is owed, and how long those balances have been outstanding. This is critical for managing cash flow and ensuring that the company has sufficient liquidity to meet its own obligations.

Identify Potential Bad Debts:

By regularly reviewing the Trade Receivable Report, businesses can identify customers who are consistently late in making payments. This allows for early intervention, such as sending reminders or renegotiating payment terms, to reduce the risk of bad debts.

Support Informed Credit Decisions:

The report provides the necessary data to make informed decisions about extending credit to customers. It helps in assessing the creditworthiness of customers based on their payment history, which is crucial for maintaining a healthy balance between sales growth and financial stability.

Reconcile with Financial Statements:

The Trade Receivable Report complements other financial reports such as the Trial Balance and Balance Sheet by providing a detailed breakdown of the amounts listed under receivables. This ensures consistency and accuracy across all financial statements.

Relationship to the Debtors List in the Sales Module

The Trade Receivable Report is similar to the Debtors List found in the Sales module of ALZERP. Both reports focus on customers with outstanding balances, but the Trade Receivable Report is typically more detailed and is specifically designed to align with financial reporting standards. It provides a snapshot of receivables as of a specific date, whereas the Debtors List might provide a broader overview of customer balances over time.

Conclusion

The Trade Receivable Report in ALZERP Cloud ERP Software is an indispensable tool for businesses that need to effectively manage their accounts receivable. By offering detailed insights into outstanding customer balances, this report helps in maintaining healthy cash flow, preventing bad debts, and making sound credit decisions. Its ease of use, customizable filters, and professional formatting make it a key component of any company’s financial management strategy.

Comments