ALZERP | Streamline VAT & Tax Management in Saudi Arabia| ZATCA-Compliant Cloud ERP Software

- Alwajeez Tech

- Aug 31, 2024

- 10 min read

Efficient VAT data processing is essential for businesses operating in Saudi Arabia to comply with ZATCA (Zakat, Tax, and Customs Authority) regulations. ALZERP Cloud ERP Software offers comprehensive features for VAT data processing, ensuring accurate VAT reporting and compliance. This article explores the capabilities of ALZERP Cloud ERP Software in VAT data processing, from connecting with the ZATCA server to preparing VAT and Zakat returns.

ALZERP Cloud ERP is a powerful software designed to streamline VAT (Value Added Tax) management and ensure compliance with ZATCA (General Authority of Zakat and Tax) regulations in Saudi Arabia. This comprehensive solution offers a range of features to automate VAT data processing, simplify tax calculations, and facilitate timely reporting.

This feature is only available for on-premises deployments.

Key Features of ALZERP’s VAT Data Processing:

ZATCA Server Integration: ALZERP seamlessly connects with the ZATCA server using the business identification number, enabling real-time data exchange and synchronization.

Data Synchronization: The software automatically synchronizes various data points, including opening balances, purchase and LC details, VAT sales, item returns, expenses, voucher data, and data corrections.

VAT Return and Zakat Return Calculation: ALZERP accurately calculates VAT and Zakat return amounts based on the synchronized data, ensuring compliance with tax regulations.

Separate Invoice Management: Invoices from sales are created in a separate table, allowing for efficient tracking and management.

Non-VAT Invoice Processing: ALZERP automatically processes non-VAT invoices with the applicable 15% VAT amount.

Invoice Item Synchronization: Any changes made to items in VAT invoices are reflected in the corresponding non-VAT invoices, maintaining consistency.

Opening Balance Synchronization: ALZERP synchronizes opening balances for products, stock, parties, and accounts heads as of December 31, 2022.

Purchase and LC Synchronization: The software synchronizes purchase and LC data within specified date ranges, capturing all relevant transactions.

VAT Sales Synchronization: VAT sales data is synchronized, including the option to enable automatic ZATCA submission.

Sold Item Returns Synchronization: Returned items are recorded in a separate table, and existing data within the same date range is replaced.

Voucher Data Processing: ALZERP processes expenses and bookkeeping vouchers, excluding non-VATable items and focusing on relevant payment, receipt, and journal vouchers.

Data Correction and Reprocessing: The software allows for rechecking and correcting synced data, processing bank statements, and reprocessing sales as needed.

Details of VAT Data Processing in ALZERP

1. Connection with ZATCA Server by Business Identification Number: ALZERP Cloud ERP Software facilitates seamless connectivity with the ZATCA server using the business’s identification number. This integration ensures that all VAT-related data, including sales, purchases, and expenses, is synchronized and submitted accurately. This direct connection allows businesses to maintain real-time communication with ZATCA, ensuring compliance with Saudi tax regulations.

2. Synchronization and Submission of VAT Data: ALZERP offers extensive capabilities to synchronize and submit various types of financial data required for VAT return filing. The system supports the synchronization of:

Opening Balances: Syncs all products with current prices, stock balances, party names (customers, suppliers, customs agents), and account head closing balances as of 31/12/2022.

Purchase and LC Data: Synchronizes local purchases, letters of credit (LC), VAT-added purchases, and expenses. The system also manages payments to local suppliers within a specified date range.

VAT Sales Data: Allows users to synchronize VAT sales data from a specific date range. Sales invoices are created separately in another table, and non-VAT invoices are processed with a 15% VAT amount. Any changes to items in VAT invoices are mirrored in non-VAT invoices to maintain consistency.

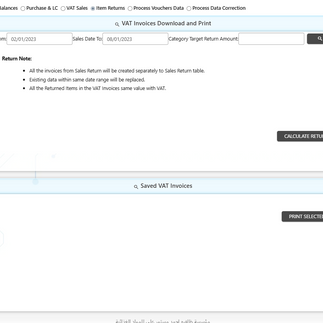

Sold Item Returns: Processes sales returns by creating entries in a separate sales return table. Existing data within the same date range is replaced, ensuring accurate reflection of returned items with their corresponding VAT values.

3. Preparation of VAT and Zakat Return Amounts: ALZERP enables businesses to locally prepare VAT and Zakat return amounts. This preparation is vital for ensuring that all VAT obligations are met and that businesses are ready for Zakat assessments. The software’s capability to handle both VAT and Zakat returns streamlines the tax management process, reducing the risk of errors and non-compliance.

Detailed Workflow of VAT Data Processing

1. Sync Opening Balances: ALZERP syncs the following data as part of the opening balances:

All Products with Current Prices: Ensures that the latest product prices are reflected in the system.

Stock Balances: Syncs current stock balances for accurate inventory management.

Party Names and Closing Balances: Synchronizes customer, supplier, and customs agent names along with their closing balances as of the specified date (31/12/2022).

Accounts Heads Closing Balances: Syncs all account heads’ closing balances to provide a comprehensive view of financial standing as of the end of the fiscal year.

2. Sync Purchase & LC Data: Within a defined date range (e.g., 02/01/2023 to 08/01/2023), ALZERP syncs:

All Local Purchases and LC: Includes all local purchases and letters of credit, ensuring that the procurement data is up-to-date.

VAT-added Purchases and Expenses: Tracks all purchases and expenses where VAT is applied, facilitating accurate VAT reporting.

Payments to Local Suppliers: Syncs payment data to local suppliers, essential for managing cash flow and supplier relationships.

3. Sync VAT Sales: For VAT sales data synchronization:

Date Range Selection: Users can specify the sales date range (e.g., 02/01/2023 to 08/01/2023).

Automatic ZATCA Submission: An option to enable auto-submission to ZATCA ensures timely and accurate reporting.

VAT Invoice Processing: VAT invoices are processed separately, and any changes in VAT invoices are reflected in the corresponding non-VAT invoices.

4. Sync Sold Item Returns: To handle returns efficiently:

Sales Return Data: Creates separate entries for sales returns in a dedicated sales return table.

Replacement of Existing Data: Data within the same date range is replaced, ensuring up-to-date and accurate records of returned items and their VAT amounts.

5. Process Vouchers Data: For comprehensive financial management:

Sync Expenses and Vouchers: Syncs bookkeeping vouchers, including payment, receipt, and journal vouchers.

Selective Processing: Excludes non-VATable voucher heads and focuses on selected heads for processing. This ensures that only relevant data is included in VAT calculations.

6. Process Data Correction: ALZERP provides tools to recheck and correct data for accuracy before final submission. This includes:

Moderation Checks: Rechecks synced data for any discrepancies.

Bank Statement Processing: Ensures that all bank transactions are accurately reflected.

Sales Reprocessing: Allows for the reprocessing of sales data to correct any errors or omissions.

Benefits of Using ALZERP for VAT Data Processing:

Compliance: Ensures adherence to ZATCA regulations, minimizing the risk of penalties and fines.

Enhanced Efficiency: Automates time-consuming tasks, reducing manual errors and improving productivity.

Accuracy: Accurate VAT and Zakat calculations prevent discrepancies and errors in tax reporting.

Real-time Updates: Stays updated with the latest ZATCA requirements and regulations.

Data Security: Protects sensitive financial data through robust security measures.

Timely Reporting: Facilitates timely submission of VAT and Zakat returns.

Summary of VAT Data Processing in ALZERP

By leveraging ALZERP’s comprehensive VAT data processing capabilities, businesses in Saudi Arabia can streamline their tax management processes, improve efficiency, and ensure compliance with ZATCA regulations.

Efficiency: Automates the VAT data processing workflow, saving time and reducing the effort required to manage VAT compliance.

Accuracy: Ensures that all VAT data is accurately captured and processed, minimizing the risk of errors in VAT reporting.

Compliance: ALZERP is ZATCA compliant, ensuring that all VAT and tax-related processes adhere to Saudi regulations. This compliance is crucial for avoiding penalties and ensuring smooth audits.

Customization: Offers flexibility in data processing, allowing businesses to tailor VAT reporting to their specific needs. This customization helps businesses meet their unique tax obligations.

ALZERP: A Comprehensive Solution for VAT and Tax Management

ALZERP Cloud ERP Software stands out as a comprehensive solution for VAT and tax management in Saudi Arabia. Its capabilities extend beyond VAT data processing, offering features such as Zakat calculation, automated tax compliance, and real-time VAT reporting. By integrating with ZATCA systems and providing robust tools for tax management, ALZERP helps businesses stay compliant, optimize their tax processes, and focus on growth.

Conclusion

VAT data processing is a critical aspect of tax compliance for businesses in Saudi Arabia. ALZERP Cloud ERP Software provides a powerful and efficient solution for managing VAT data, ensuring accuracy, compliance, and ease of use. By automating and streamlining VAT processes, ALZERP enables businesses to meet their tax obligations effectively and confidently.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!– Create an account now –

Sign up

Accounting, Accounting automation software, accounting software comparison, accounting software demo, Accounting software for entrepreneurs, accounting software for mac, accounting software for small business, Accounting software for small businesses, accounting software for windows, Accounting Software for ZATCA, accounting software free trial, Accounting software in the cloud, accounting software pricing, accounting software reviews, accounting software Saudi Arabia, Accounting software with cloud storage, Accounting Statements, Affordable cloud accounting software, affordable cloud accounting software in Saud Arabia, affordable cloud accounting software Saudi Arabia, Affordable VAT, Tax, and Zakat Software, Automated cloud accounting, Automated tax compliance Saudi Arabia, Automated Tax Software ZATCA KSA, best accounting software for small business, Best cloud accounting software, best cloud accounting software in Saud Arabia, best cloud accounting software Saudi Arabia, best cloud bookkeeping software, Best VAT, Tax, and Zakat Software for Saudi Arabia, bookkeeping software for small business, bookkeeping software online, bookkeeping software Saudi Arabia, cheap cloud accounting software, Cloud accounting and inventory, cloud accounting for a trading company, Cloud accounting for accountants, cloud accounting for distribution Saudi Arabia, Cloud accounting for e-commerce, Cloud accounting for enterprises, Cloud accounting for freelancers, Cloud accounting for medium businesses, Cloud accounting for nonprofits, cloud accounting for restaurants Saudi Arabia, cloud accounting for retail, cloud accounting for retail companies Saudi Arabia, cloud accounting for retail Saudi Arabia, cloud accounting for services Saudi Arabia, cloud accounting for small business Saudi Arabia, Cloud accounting for startups, cloud accounting for traders, cloud accounting for wholesale companies, cloud accounting for wholesale Saudi Arabia, cloud accounting for wholesalers, cloud accounting for ZATCA Saudi Arabia, Cloud accounting software, cloud accounting software Dammam, cloud accounting software in KSA, cloud accounting software Jeddah, cloud accounting software Makkah, cloud accounting software Medina, cloud accounting software Riyadh, cloud accounting software Saudi Arabia, cloud accounting system Saudi Arabia, Cloud accounting with CRM integration, Cloud accounting with invoicing, Cloud accounting with reporting tools, cloud bookkeeping software, Cloud ERP accounting software, Cloud ERP with accounting module, Cloud financial management, Cloud financial reporting, Cloud-based accounting apps, Cloud-based accounting for consultants, Cloud-based accounting solution, Cloud-based asset management software, Cloud-based audit software, Cloud-based bookkeeping software, Cloud-based budgeting tools, Cloud-based cash flow management, Cloud-based ERP system, Cloud-based expense management, Cloud-based financial analysis, Cloud-based financial consolidation, Cloud-based financial dashboard, Cloud-based financial planning, Cloud-based financial software, Cloud-based payroll software, Cloud-based sales tax software, Cloud-based tax software, Cloud-based VAT Tax Zakat Software, ERP Software with ZATCA Integration, Financial software for small businesses, free cloud accounting software, Integrated cloud accounting, KSA Tax and Zakat Automation, Mobile cloud accounting software, Multi-currency accounting software, Online accounting and bookkeeping, Online accounting software, online accounting software in Saud Arabia, online accounting software Saudi Arabia, online accounting system, Online accounting with bank reconciliation, Online bookkeeping software, online bookkeeping software in Saud Arabia, online bookkeeping system Saudi Arabia, Online financial management tools, Real-time cloud accounting, Real-time tax monitoring KSA, Real-time VAT reporting KSA, Saudi Arabia e-Invoicing and Tax Software, Saudi Arabia Tax Calculator, Saudi Arabia tax filing software, Saudi Arabia tax optimization tool, Saudi Arabia tax planning software, Saudi Arabia Tax Software, Saudi Arabia VAT and Zakat Software, Saudi Arabia VAT Automation, Saudi Arabia VAT management, Saudi Arabia Zakat and Tax Software, Saudi business financial compliance, Saudi business tax management, Saudi corporate tax software, Saudi tax audit software, Saudi tax compliance software, Saudi VAT and Zakat Filing Software, Saudi VAT Compliance Tools, Saudi VAT reconciliation software, Saudi Zakat and Tax Management, Scalable cloud accounting software, Secure cloud accounting, small business accounting Saudi Arabia, small business accounting software, small business bookkeeping software, Small business cloud accounting, Tax, Tax analytics for Saudi businesses, Tax and Zakat Filing KSA, Tax and Zakat Software Saudi Arabia, Tax Compliance Software for Small Businesses in Saudi Arabia, Tax Compliance Software Saudi Arabia, Tax Compliance Software ZATCA, Tax Consulting Software Saudi Arabia, Tax Filing Software Saudi Arabia, Tax management system Saudi Arabia, Tax Reporting Solutions Saudi Arabia, Tax Software for Businesses in Saudi Arabia, top accounting software in Saud Arabia, VAT, VAT and Tax Reporting Software, VAT and Tax Return Filing Software for SMEs in Saudi Arabia, VAT compliant accounting software Saudi Arabia, VAT Filing Software Saudi Arabia, VAT fraud detection Saudi Arabia, VAT invoice management Saudi Arabia, VAT management for Saudi SMEs, VAT Management Software Saudi Arabia, VAT reporting software KSA, VAT return automation Saudi, VAT Return Filing Software, VAT Return Filing Software for Freelancers in Saudi Arabia, VAT Return Submission Software, VAT Tax Zakat Software, VAT Tax Zakat Software with ZATCA API, VAT, Tax, and Zakat Management Software Saudi Arabia, Zakat and income tax software, Zakat and tax automation, Zakat and tax consultation tool, Zakat and tax filing deadline alerts, Zakat and tax regulations update, Zakat and VAT calculator, Zakat and VAT compliance check, Zakat and VAT Software for Saudi Businesses, Zakat assessment tool, Zakat Calculation Software, Zakat Calculation Software KSA, Zakat Compliance Software KSA, Zakat compliant accounting software Saudi Arabia, Zakat declaration software, Zakat Due Calculator, Zakat Filing Software Saudi Arabia, Zakat Management System KSA, Zakat, VAT, and Tax Software Saudi Arabia, ZATCA API Integration, ZATCA approved ERP, ZATCA Approved Tax Software, ZATCA Compliance Audit, ZATCA Compliant Accounting Software, ZATCA Compliant ERP Software, ZATCA Compliant Software, ZATCA data submission software, ZATCA digital reporting platform, ZATCA e-Invoice Software, ZATCA E-Invoice Software for Saudi Businesses, ZATCA e-Invoicing Software, ZATCA e-invoicing solution, ZATCA E-Services, ZATCA electronic invoicing, ZATCA Integrated Accounting Software, ZATCA Integration for ERP Systems, ZATCA integration software, ZATCA penalty avoidance system, ZATCA Registration Software, ZATCA Tax Filing Software, ZATCA Tax Return Filing Software, ZATCA VAT Reporting Solutions, ZATCA VAT, Tax and Zakat Management Software in Saudi Arabia | ALZERP, ZATCA-approved tax solution, ZATCA-compliant e-invoicing system, ZATCA-Compliant Tax Solutions

View on Threads

VAT Data Processing in ALZERP Cloud ERP Softwarehttps://t.co/Duu3wF4DWD— Alwajeez Technology (@AlwajeezTech) August 31, 2024

Comments